The UK Gambling Commission continues its series of penalty-imposing actions, with the latest operator, Betway, fined a record £11.6 million for failure with regards to gambling addiction protection and player source of funds checks.

The gambling regulator in the UK meted the severe punishment to Betway, after it had found out serious violations in dealings with high-spendingVIP clients that meant the operator handled around £5.8 million of suspected criminal proceeds, and the gambling Commission is now returning the money to the victims.

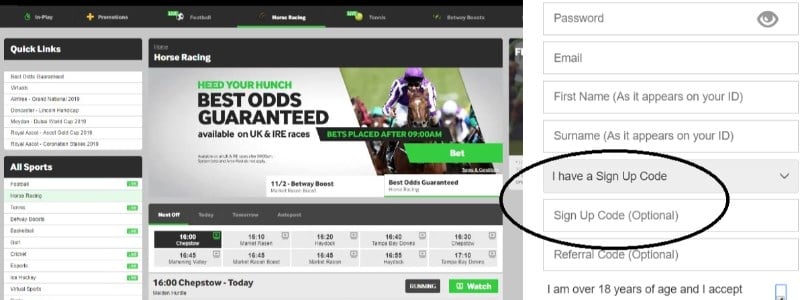

Online gambling operator Betway has agreed to pay a penalty of £11.6 million for a series of social responsibility and money laundering violations connected to the accounts of seven of its “VIP” customers. In one case, Betway failed to do the source checking of funds from a “VIP” customer who deposited more than £8m. Betway has been found to offer such goodies on several occasions, leading to a $520,000 fine. Betway has been warned about its conduct and beaching the rules that allow it to operate legally in the country. In an official statement, Spelinspektionen reiterated its position on protecting consumers. Online betting firm Betway has been hit with a record penalty of £11.6m for failings over customer protection and money-laundering checks. The Future for Betway. The fine will hurt in the short term, there’s no doubt about that, but this sort of thing hasn’t tended to keep customers away from bookies that have been through it in the past. William Hill were issued with a £6.2 million fine at the start of 2018 and they seem to be doing ok last I checked.

In one of these VIP cases, Betway allowed a customer to deposit over £8 million, in the span of four years, lose £4 million and in the meantime having his account flagged 20 times as a potential risk, only in each of these occasions for the staff to accept the client’s word as evidence of the source of the funds. Even the board of directors of the company, when the case was referred to them, allowed the gambler to continue, with the actual closure of the client’s account happening after the police’s intervention.

Another client was allowed to deposit £1.6 million and lose more than £700,000, in a period of 3 years, despite being unemployed, and Betway failed to verify customer employment status due to reliance on open source information that confirmed the client could afford the losses.

A violation of the customer self-exclusion policy was found when a client made a series of deposits totaling £494,000 into 11 different accounts, after that customer had previously signed up to exclude from gambling, a glaring example of gambling addiction behavior.

Another VIP client deposited and lost £187,000 in just 2 days, without being asked by Betway’s staff about the source of the money.

“The actions of Betway suggest there was little regard for the welfare of its VIP customers or the impact on those around them. As part of our ongoing programme of work to make gambling safer, we are pushing the industry to make rapid progress on the areas that we consider will have the most significant impact to protect consumers” Richard Watson, Executive Director, UK Gambling Commission.

Betway will pay £5.8 million back to the victims of the crimes committed by its customers, plus another £5.8 million to the Gambling Commission that will be spent to reduce gambling addiction. Betway accepted to pay the penalty and improve their existing processes.

“Betway takes full responsibility for the small number of historic cases which have led to this settlement. We have fully cooperated with the investigation and will take further proactive steps to ensure all recommendations and findings are implemented” Anthony Werkman, CEO, Betway.

The latest imposed financial penalty by the UKGC is almost 4 times the amount of the previous one, the £3 million fine meted to Mr Green, an online gaming company owned by William Hill, and the GC is determined to make the gambling environment safer in times when the society shows sensitivity on the matters.

Betway has been handed a hefty fine of £11.6 million from UK regulator, the Gambling Commission. The online gambling firm has been ordered to pay up following failures in its social responsibility practices. The gambling regulator’s findings also uncovered links between some of the firm’s highest-spending customers and failures to control money laundering. This fine joins a number of others levied against some of the UK’s biggest gambling companies, as the Gambling Commission seeks to tighten up regulations.

Betway is just the latest in a string of operators to be slapped with penalties by the Gambling Commission, in it’s latest crackdown. ©Pixabay/Pexels

Regulator Uncovers Failures

The Gambling Commission has levied a record-breaking penalty of £11.6 million against British gambling operator Betway. The penalty is the largest of it’s kind to be brought upon a UK gambling company. It comes as the latest in a string of large fines and tough measures, which includes the recent credit card ban. It is clear that the Gambling Commission is trying to send a message.

Following a probe into Betway’s business practices, the Gambling Commission made a number of concerning discoveries, which led to the huge fine. In one example cited by the regulator, Betway failed to carry out a “source of funds” check on a VIP customer. The customer was allowed to deposit more than £8 million and lose over £4 million over the course of four years.

Another instance saw Betway fail to conduct “effective social responsibility interactions” as a customer deposited and lost £187,000 in just two days. Regulatory rules dictate that gambling firms do have to check that customers are sourcing funds legitimately and that customers are protected from gambling harms.

“The actions of Betway suggest there was little regard for the welfare of its VIP customers or the impact on those around them.”

On top of these cases, the Gambling Commission has stated that it has reason to suspect that around £5.8 million could have been funneled through Betway without adequate customer checks. In the absence of any assurance that this money was sourced legitimately, it could be linked with crime.

Betway will now have to return most of this sum back to victims. Investigations into Personal Management License holders are still being carried out as a result the oversights uncovered by the regulator. The Gambling Commission’s Executive Director, Richard Watson, has called for change in how operators manage VIP customers.

“As part of our ongoing program of work to make gambling safer we are pushing the industry to make rapid progress on the areas that we consider will have the most significant impact to protect consumers. The treatment and handling of high-value customers is a significant piece of that work and operators are in no doubt about the need to tackle the issue at speed.”– Richard Watson, Executive Director, Gambling Commission

Watson added that deadlines have been put in place and that Betway’s progress will be carefully monitored. As is the case with other operators in the same situation, a failure to show results will lead to further action from the Gambling Commission. Betway is the tenth British operator to get such as penalty since 2018.

VIP Crackdown

Betway Fine Arts

VIP schemes are designed to reward the loyalty of customers who play frequently and wager significant amounts at casino sites. Rewards come in the form of gambling bonuses, free wagers, exclusive offers and tailored customer care services. These reward systems encourage customers to keep playing and revisiting the same site.

While VIP schemes might seem like a generous deal to many players, they have come under fire from gambling campaigners and politicians. It is expected that a review of the 2005 Gambling Act will be carried out this year, with tougher new rules likely to be brought in.

Labor MP Carolyn Harris is one of the UK’s most vocal politicians campaigning for better standards in the gambling industry. Harris chairs the Gambling Related Harm APPG, which successfully campaigned for stake limits on FOBTs. Speaking to the Guardian, she said that penalties are not enough for massive companies like Betway.

“Just how exploitative has a gambling company got to be before the Gambling Commission suspends their license? Betway’s fine for calculated and deliberate manipulation of VIP customers is paltry in comparison with the damage they will have caused to those caught in the web of VIP inducements.”– Carolyn Harris MP, Chair, Gambling Related Harm APPG

Beltway Fine Wine & Spirits Towson

In a scathing attack, Harris went on to describe the gambling industry as “morally corrupt” and claimed that the Gambling Commission is “complicit”.

This type of penalty has become an increasingly common sight, as the Gambling Commission seeks to raise industry standards. Just earlier this month it was announced that Mr Green has been handed a £3 million penalty, over similar “systematic failings”.

Beltway Fine Wine

At Mr Green, inadequacies were found in its safeguards against money laundering as well as it “source of funds” checks. Out of the 22 personal management holders that the regulator investigated, six lost licenses and six more were given formal warnings.